The inventory turnover ratio is a crucial metric that provides insights into the efficiency of a company’s inventory management. Understanding this ratio is essential for businesses to optimize their inventory levels, reduce holding costs, and maximize profitability. In this comprehensive guide, we will delve into the concept of inventory turnover ratio, its calculation, and its significance in evaluating a company’s operational performance. We will also explore the benefits of monitoring and improving inventory turnover ratio and provide practical tips for effectively managing inventory. Whether you are a business owner, manager, or financial analyst, this guide will equip you with the knowledge and tools to make informed decisions and drive success through effective inventory management.

What is Inventory Turnover Ratio?

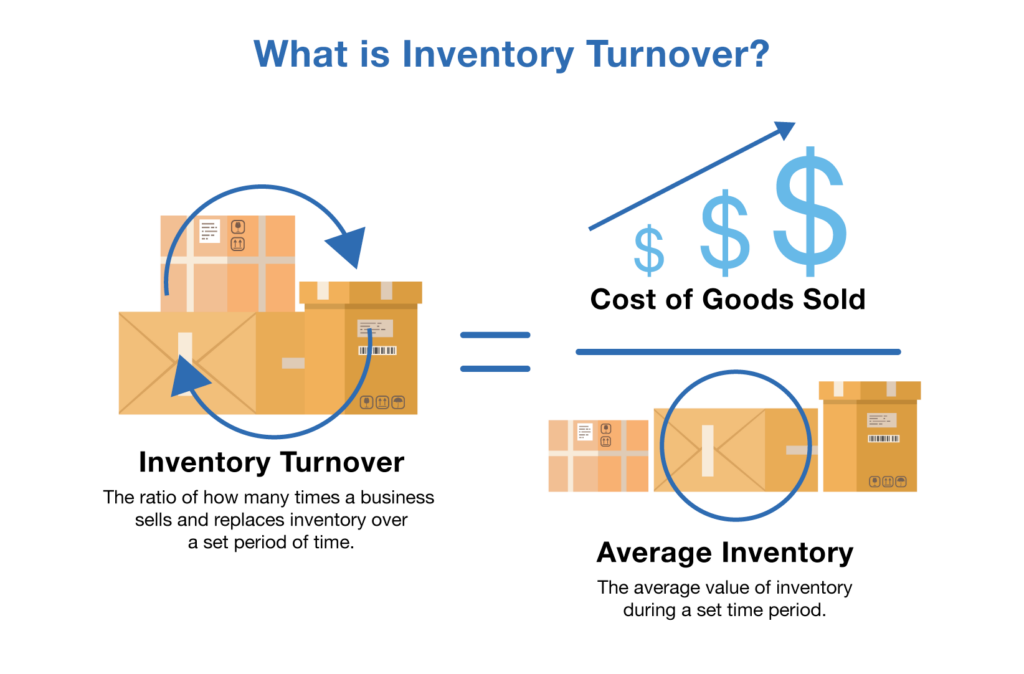

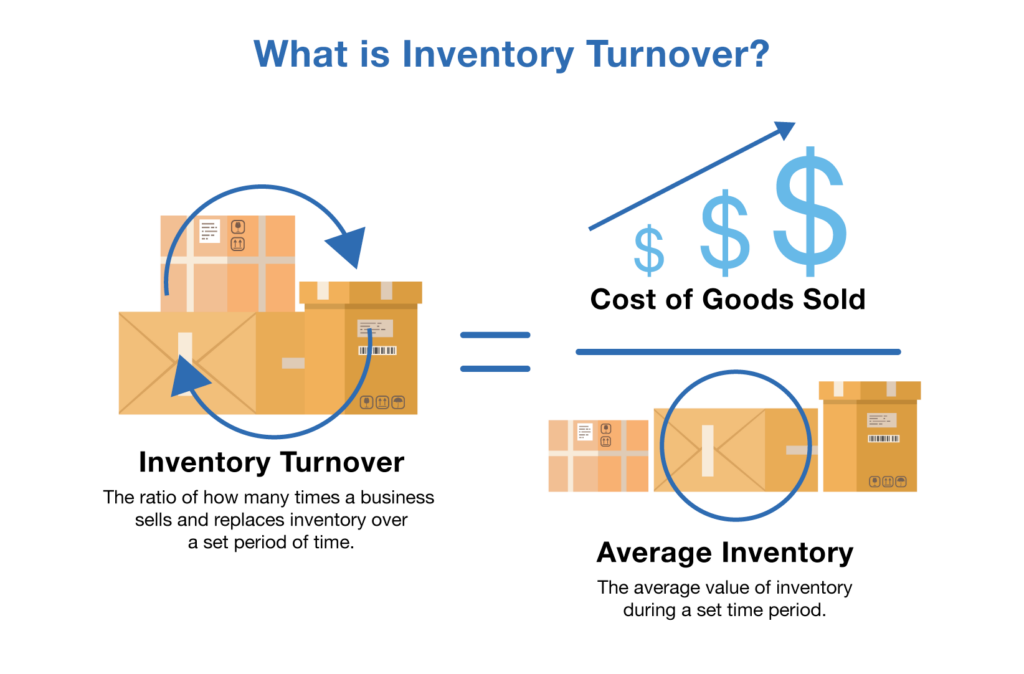

Inventory turnover ratio is a financial metric used to measure the efficiency of a company’s inventory management. It indicates how quickly a company is able to sell its inventory and replace it with new stock over a specific period of time.

The inventory turnover ratio is calculated by dividing the cost of goods sold (COGS) by the average inventory during a given period. The formula is as follows:

COGS represents the cost of the goods that a company has sold during a particular period. Average inventory is calculated by taking the sum of the beginning and ending inventory balances and dividing it by two.

A higher inventory turnover ratio is generally seen as favorable because it suggests that a company is selling goods in stock quickly and efficiently, minimizing holding costs and the risk of obsolescence. However, excessively high turnover ratios may indicate stockouts or insufficient inventory levels, potentially leading to lost sales.

Conversely, a lower inventory turnover ratio may indicate slower sales, excess inventory levels, or ineffective inventory management. It could also suggest that a company is facing challenges in selling its products.

It is important to note that the ideal inventory turnover ratio varies across industries. For example, industries with perishable goods or fast-changing products often have higher turnover ratios compared to industries with durable goods or long shelf-life products.

Analyzing the inventory turnover ratio in conjunction with other financial metrics and industry benchmarks can provide valuable insights into a company’s operational efficiency, goods in stock management practices, and overall financial health.

Importance of Calculating Inventory Turnover Ratio

Calculating and tracking inventory turnover helps businesses make smarter decisions in a variety of areas, including pricing, manufacturing, marketing, purchasing and warehouse management. Ultimately, the inventory turnover ratio measures how well the company generates sales from its stock.

Why is it important?

Enhancing Operational Efficiency

Calculating helps businesses evaluate their operational efficiency. A high turnover ratio signifies that inventory is moving quickly, indicating a well-functioning supply chain, effective production planning, and streamlined distribution channels. Conversely, a low turnover ratio implies sluggish sales, excess inventory, and potential issues such as overstocking or obsolete stock. By monitoring the inventory turnover ratio regularly, businesses can identify operational bottlenecks and make informed decisions to improve efficiency.

Optimizing Working Capital Management

Efficient inventory management is crucial for optimizing working capital. Excessive inventory ties up valuable financial resources and increases holding costs. By calculating it, businesses can identify excessive inventory levels and take necessary actions to reduce carrying costs. A higher turnover ratio indicates that inventory is selling quickly, minimizing the need for excessive working capital investment. This allows businesses to allocate resources more effectively, improve cash flow, and reinvest in other areas of the organization.

Monitoring Sales Performance

It provides valuable insights into a company’s sales performance. By tracking this ratio over time, businesses can assess the effectiveness of their sales strategies and adjust them accordingly. A declining turnover ratio might indicate declining sales or an inability to meet customer demand. It can help identify seasonal variations, changes in customer preferences, or potential competitive threats. By closely monitoring the inventory turnover ratio, businesses can proactively address sales-related issues and implement appropriate measures to boost sales.

Identifying Inventory Obsolescence and Deadstock

Regularly calculating the inventory turnover ratio enables businesses to identify inventory obsolescence and deadstock. A low turnover ratio may indicate slow-moving or obsolete inventory, which ties up valuable storage space and reduces profitability. By recognizing these inventory issues, businesses can implement strategies to liquidate obsolete stock, such as offering discounts, running promotions, or exploring alternative markets. This helps free up storage space, reduces carrying costs, and minimizes losses associated with obsolete or dead stock.

Benchmarking and Industry Comparison

Calculating it allows businesses to benchmark their performance against industry standards and competitors. It helps in evaluating whether a company’s inventory management practices are in line with industry norms or if there is room for improvement. By comparing the turnover ratio with industry averages, businesses can identify areas of strength and weakness. This analysis can guide decision-making and foster a proactive approach to stay competitive in the market.

How to improve inventory turnover?

Improving inventory turnover is crucial for optimizing business operations and financial performance.

Several strategies to help you improve inventory turnover:

Demand forecasting

Accurate demand forecasting is essential to understand customer needs and avoid overstocking or understocking items. Analyze historical data, market trends, and customer insights to forecast demand more accurately, allowing you to adjust inventory levels accordingly.

Efficient inventory management

Implement robust inventory management practices to streamline operations and reduce carrying costs. This includes optimizing reorder points, setting realistic safety stock levels, and adopting inventory tracking systems to ensure accurate inventory counts.

ABC analysis

Conduct an ABC analysis to categorize inventory items based on their value and prioritize management efforts accordingly. Classify items into three categories: A (high-value, fast-moving items), B (moderate-value, moderate-moving items), and C (low-value, slow-moving items). Focus on optimizing the management of high-value items to improve turnover.

Supplier partnerships

Build strong relationships with reliable suppliers who can provide timely deliveries and competitive pricing. Collaborate closely with suppliers to align production and delivery schedules, minimizing lead times and stockouts. Negotiate favorable terms such as shorter lead times and flexible order quantities.

Just-in-time (JIT) inventory

Adopt a just-in-time inventory management approach where inventory is received and processed as close as possible to when it’s needed. This reduces storage costs and the risk of holding excess inventory. However, careful planning and coordination with suppliers and production processes are essential for JIT to be effective.

Seasonal and promotional planning

Anticipate seasonal fluctuations and plan inventory levels accordingly. Consider historical data and market trends to adjust stock levels during peak and off-peak periods. Additionally, plan for promotional activities and allocate inventory to capitalize on increased demand during specific periods.

Inventory analysis and optimization

Regularly analyze inventory data to identify slow-moving or obsolete items. Implement strategies such as discounting, bundling, or discontinuing these items to free up capital and reduce carrying costs. Invest in inventory optimization tools or software that can provide insights into demand patterns and optimal stock levels.

Cross-functional collaboration

Foster collaboration between departments such as sales, marketing, and operations. Aligning these teams’ efforts improves communication and coordination, leading to more accurate demand forecasting and better inventory planning.

Continuous improvement and measurement

Monitor key performance indicators (KPIs) related to inventory turnover, such as inventory turnover ratio and DSI. Regularly assess and measure these metrics to identify areas for improvement. Set specific goals, track progress, and continuously seek ways to optimize inventory management processes.

It is a vital financial metric that offers valuable insights into a company’s operational efficiency, working capital management, sales performance, and inventory health. By regularly calculating and monitoring this ratio, businesses can identify areas of improvement, make informed decisions, optimize working capital, and enhance profitability. The inventory turnover ratio serves as a powerful tool for evaluating inventory management practices, benchmarking against industry peers, and ensuring sustainable growth in today’s dynamic business environment.