In the bustling world of e-commerce, the importance of effective inventory management cannot be understated. It’s a crucial cog in the well-oiled machine that your business strives to be. At the heart of this mechanism lies a key concept – inventory costs.

Inventory costs represent more than just the price you pay for your products. It’s a comprehensive term, enveloping every expense associated with keeping your inventory—from the cost of purchasing or manufacturing the goods, to the expenses of storing, managing, and insuring important? The answer lies in how these costs impact all aspects of your business operations. From pricing strategies and profit margins to cash flow and overall business health, the ripple effect of inventory costs is felt widely.

Knowing your inventory costs can help in setting the right product prices that cover your costs and ensure profitability. It helps in forecasting future inventory needs, thereby ensuring your customers always find what they need, when they need it. It also plays a vital role in identifying where you might be spending excessively and where there is room for cost reduction.

Yet, accurately calculating inventory costs can often feel like navigating a maze, given the various factors involved. Fear not, for our comprehensive guide is here to shed light on this crucial aspect. We’ll dive deep into the components of inventory costs, break down the formulas for calculating them, and highlight their importance in successful inventory management.

So, whether you’re just dipping your toes into the e-commerce world or looking to strengthen your existing business operations, mastering inventory costs is your first step towards improved financial health and business success. Let’s embark on this journey together!

Understanding the Crucial Aspects of Inventory Costs

Inventory costs are an essential part of any e-commerce business. Having a thorough understanding of these costs, how they accumulate, and ways to manage them can provide your business with a competitive edge, enhance your profitability, and ultimately drive your business growth.

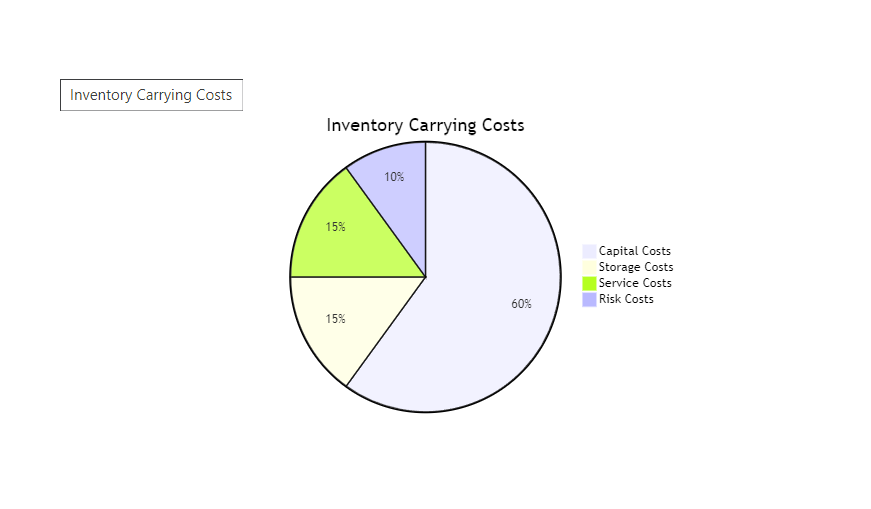

Inventory Carrying Costs: A Key Component

Inventory carrying costs, also known as holding costs, can significantly impact your bottom line. These costs can be broken down into four main categories: capital costs, storage costs, service costs, and risk costs.

- Capital Costs: This is the cost of investment tied up in inventory. It’s the largest component of carrying costs, usually accounting for about 60%. It includes taxes and insurances paid on inventory and opportunity cost of the money spent on inventory.

- Storage Costs: These costs include everything associated with storing inventory such as warehouse rent, utilities, and warehouse management salaries.

- Service Costs: These are costs related to handling inventory, including insurance and technology needed to manage and track inventory.

- Risk Costs: These encompass costs of inventory becoming obsolete, deteriorating, or getting stolen or damaged.

Ordering Costs and Their Significance

Ordering costs, also called setup costs, are incurred when placing and receiving orders. These can include transportation and shipping costs, paperwork costs, and costs associated with inspecting and incorporating goods into existing inventory.

Strategic Steps to Minimize Inventory Costs

Managing inventory costs effectively involves numerous strategies. Here are some proven approaches your business can implement:

- Adopt a JIT (Just-In-Time) Approach: This inventory management technique aims to increase efficiency and decrease waste by receiving goods only when they are needed, thus reducing stock cost.

- Implement an EOQ (Economic Order Quantity) Model: The EOQ model minimizes the total cost of inventory by determining the number of items your business should order to reduce inventory holding and ordering costs.

- Leverage Dropshipping: Dropshipping can help reduce storage and service costs as you don’t need to hold any inventory. Instead, products are shipped directly from your supplier to the customer.

- Use Inventory Management Software: Leveraging technology can help you optimize your inventory management, reducing both holding and ordering costs.

- Regular Inventory Audits: Frequent audits can help avoid stock discrepancies, overselling, and shrinkage, thereby saving on risk costs.

- Optimize Warehouse Operations: Implementing efficient warehouse operations can minimize storage costs. These operations can include an optimal layout, efficient picking and packing processes, and automation where possible.

Calculating Inventory Costs: The Ultimate Formula

Unveiling the complexities of inventory management, one of the essential elements to understand is the inventory cost calculation. At its core, this formula provides a tangible figure, bringing into perspective your overall operational expenses.

A Comprehensive Look at the Inventory Cost Formula

Inventory cost is calculated as the sum of the cost of goods sold (COGS) and the ending inventory. This formula provides a comprehensive overview of your total stock cost:

Inventory Cost = Cost of Goods Sold (COGS) + Ending Inventory

- Cost of Goods Sold (COGS): This is the cost of producing the goods sold by a company. It includes both direct costs like raw material and labor costs used in creating the goods, as well as any indirect costs.

- Ending Inventory: This is the amount of inventory a company has in its possession at the end of a financial period. It includes raw materials, work-in-progress (WIP), and finished goods.

Making Sense of Inventory Cost in Real-Time

Consider a company ‘X’ that started the year with no inventory. During the year, it produced goods costing $200,000 (the COGS). At the end of the year, company ‘X’ had $50,000 worth of unsold goods (the ending inventory).

Using the inventory cost formula:

Inventory Cost = COGS + Ending Inventory

The total inventory cost for company ‘X’ will be $200,000 (COGS) + $50,000 (Ending inventory) = $250,000

Hence, company ‘X’ spent $250,000 on its inventory during that year.

Incorporating the Beginning Inventory

In most cases, businesses start their financial period with some inventory on hand, also known as the beginning inventory. In such a scenario, the formula to calculate inventory cost changes slightly to accommodate this variable:

Inventory Cost = Beginning Inventory + Purchases – Ending Inventory

Here:

- Beginning Inventory: This is the value of all the inventory a business has in stock at the start of a fiscal year or accounting period.

- Purchases: These are all the additional inventory items bought during the fiscal year.

- Ending Inventory: This remains the same as in the previous formula, representing all the unsold inventory at the end of the accounting period.

Practical Application of the Expanded Formula

Consider a business ‘Y’ that starts the year with an inventory worth $30,000. During the year, ‘Y’ purchases an additional inventory worth $150,000. At the end of the year, the business has $40,000 worth of unsold inventory.

Using the expanded inventory cost formula:

Inventory Cost = Beginning Inventory + Purchases – Ending Inventory

The inventory cost for business ‘Y’ would be $30,000 (Beginning Inventory) + $150,000 (Purchases) – $40,000 (Ending Inventory) = $140,000.

In conclusion, inventory cost calculation is crucial for businesses to monitor and control their expenditure efficiently. While the formula might seem complex, understanding each component and what they represent makes it manageable and beneficial to implement. After all, in the world of e-commerce, knowledge is power!

https://leuleullc.com/2023/06/25/the-ending-inventory-formula-a-simplified-guide/