Inventory turnover ratio, an essential part of efficient supply chain management, is the cornerstone of healthy retail and e-commerce businesses. Let’s take a deep dive into the concept, its calculation, and strategies to optimize it for the growth of your business.

What Is Inventory Turnover Ratio?

The inventory turnover ratio, at its core, is a key performance indicator (KPI) which enables companies to gauge their inventory management efficiency. Essentially, it measures how many times a company has sold and replaced its inventory over a certain period.

How To Calculate Inventory Turnover Ratio?

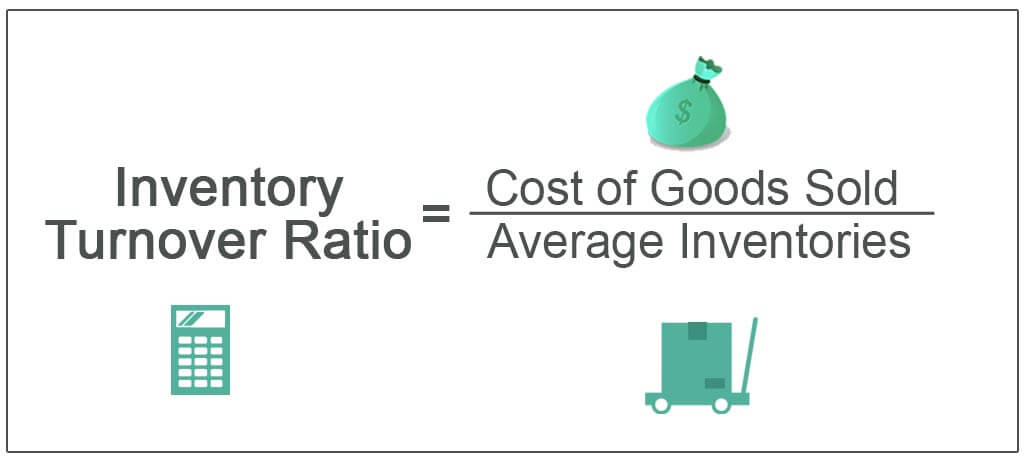

Calculating the sales turnover ratio isn’t rocket science. It’s a straightforward formula: divide the cost of goods sold (COGS) by the average inventory during the period under consideration.

Step 1: Determine Your Cost of Goods Sold (COGS)

The Cost of Goods Sold, or COGS, represents the total cost of all the goods a company has sold during a specific time period. It includes the cost of materials and labor directly tied to the production of the goods sold. You can typically find this information on your company’s income statement.

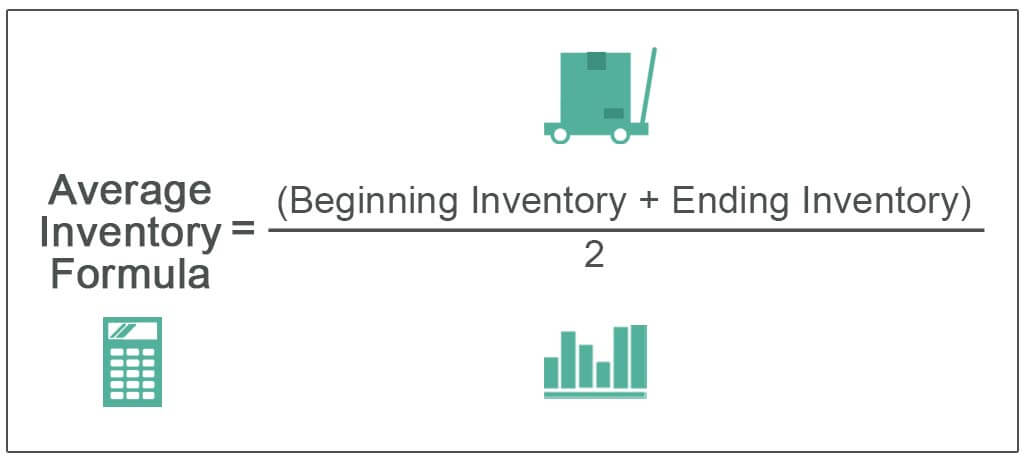

Step 2: Calculate Your Average Inventory

Next, you’ll need to figure out your average inventory for the same time period. You can calculate this by adding the value of the inventory at the beginning of the period to the value at the end of the period, and then dividing by two.

The values for the beginning and ending inventory are usually available on your company’s balance sheet.

Step 3: Calculate the Inventory Turnover Ratio

Once you have both the COGS and Average Inventory, you can calculate the sales turnover ratio by dividing the COGS by the Average Inventory.

The COGS refers to the direct costs of producing the goods sold by a company, while the average inventory represents the midpoint inventory level during the specified period.

Why Is Calculating Inventory Turnover Ratio Important?

Calculating the sales turnover ratio is vital for several compelling reasons, making it a key pillar in inventory management strategies. Let’s dive into why it’s so critical for your business.

Fine-tuning Inventory Management

The sales turnover ratio provides a clear snapshot of how effectively your business is managing inventory. High turnover indicates that you’re selling goods swiftly, which suggests your stock levels are well-aligned with customer demand. On the other hand, a low turnover could signal overstocking, tying up cash in unsold goods, and potentially leading to storage issues or inventory becoming obsolete. By monitoring this ratio, businesses can identify and address these challenges promptly.

Financial Health and Liquidity

Inventory represents a significant investment for many businesses, especially those in retail and manufacturing. An effective sales turnover ratio means your investment isn’t sitting idle on shelves, but is instead being converted into cash or accounts receivable. The faster this cycle, the quicker your cash inflow. In other words, a healthy sales turnover ratio can improve your business’s liquidity and overall financial health.

Supply Chain Efficiency

Your inventory turnover ratio can also shed light on your supply chain efficiency. A higher ratio might be a sign that your procurement processes, supplier relationships, and logistics are well-coordinated, ensuring products are available when customers need them. Conversely, a low ratio could flag potential inefficiencies or bottlenecks in the supply chain that may require attention.

Improved Customer Satisfaction

Lastly, calculating and optimizing your inventory turnover ratio plays a direct role in customer satisfaction. When inventory levels are well-managed, it means customers can find what they need when they need it – an important factor in providing a positive customer experience. Additionally, a quick inventory turnover can often mean that products are fresh and up-to-date, another plus point from a customer perspective.

Inventory Turnover Ratio: Unveiling What the Numbers Mean

The sales turnover ratio provides crucial insights into a business’s operational efficiency and financial health. A higher ratio indicates brisk sales and efficient inventory management, as goods don’t remain on shelves for too long. Conversely, a lower ratio might suggest slow-moving inventory, potential overstocking, or an obsolete stock issue.

Sales Turnover Ratio And Its Impact On Cash Flow

The sales turnover ratio is directly linked to a company’s cash flow. When inventory moves quickly, cash is not tied up in stock, improving cash flow, and providing more flexibility for the business.

Conclusion: The Power Of Sales Turnover Ratio In Business Success

The sales turnover ratio is more than a mere number. It’s a reflection of a business’s inventory management prowess, sales effectiveness, and financial health. By understanding and effectively utilizing this ratio, businesses can optimize their operations, enhance cash flows, and set themselves up for sustained success.

Capitalizing on Consignment Inventory: An Ecommerce Strategy