Want a quick measure of your business efficiency and inventory management? Look no further than the raw materials inventory turnover ratio. This handy metric reveals the frequency of your raw materials use in production. High ratios suggest strong sales and inventory control, while low ones might indicate sluggish sales or overstocking. But how to calculate this? Let’s dive into this concise guide for a simple walkthrough.

The Essence of Raw Materials Inventory

Raw materials inventory is an indispensable part of every manufacturing company’s operations. It refers to the total cost of all the components used to produce a product, but which have not yet been used in the production process. The materials may include everything from metals, rubber, and wood to grains, cotton, or chemicals.

The Significance of Raw Materials Inventory Management

Adequate direct materials inventory management can make or break a business, particularly for manufacturing companies. It involves more than just knowing how much inventory you have at a given time; it’s about understanding the dynamics of your operations, the lifecycle of your products, and the fluctuations in market demand.

Managing direct materials inventory effectively allows your company to operate smoothly, prevents production delays due to shortage of materials, reduces storage and spoilage costs, and enhances cash flow.

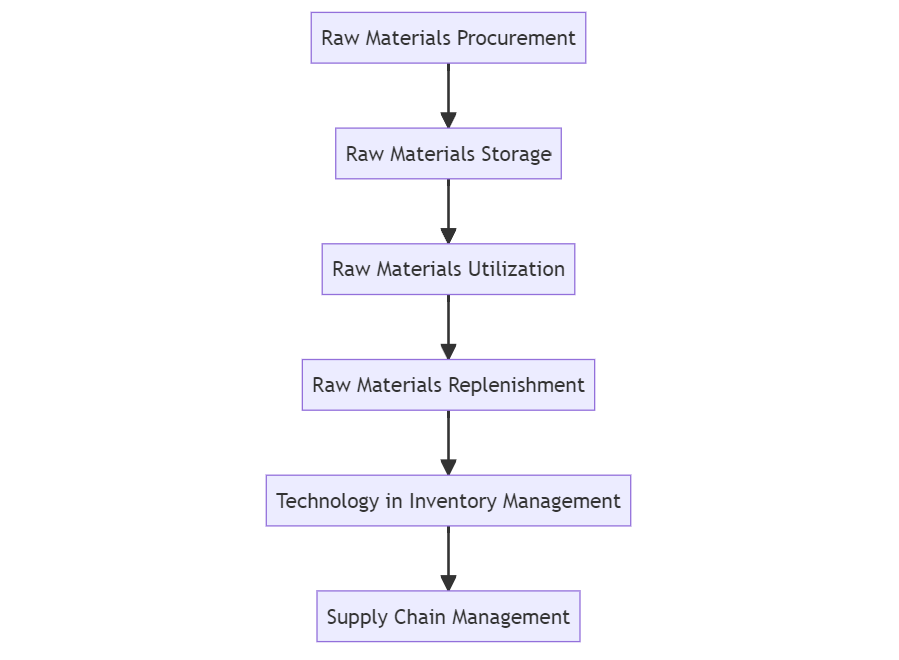

The Process of Raw Materials Inventory Management

Raw Materials Procurement

Raw materials procurement is the process of acquiring the materials necessary for production. It’s crucial to strike a balance in ordering: too much can lead to wastage and storage costs, while too little may result in production delays.

Raw Materials Storage

Upon procurement, raw materials should be adequately stored to prevent damage, spoilage, and theft. Appropriate storage facilities, conditions, and security measures need to be in place.

Raw Materials Utilization

Once in storage, raw materials should be utilized in an efficient and cost-effective manner. Real-time tracking systems can monitor usage, ensuring that raw materials are used before they spoil or become obsolete.

Raw Materials Replenishment

Adequate replenishment strategies are crucial to prevent shortages and excesses. Companies should employ accurate demand forecasting and inventory tracking systems to know when to reorder and how much.

The Role of Technology in Raw Materials Inventory Management

With advancements in technology, modern inventory management systems can help businesses automate, streamline, and optimize their direct materials inventory management. These systems allow for real-time tracking, automated reordering, and sophisticated data analytics to facilitate strategic decision making.

The Impact of Supply Chain Management

Efficient supply chain management can have a significant impact on your raw materials inventory. With a strong network of reliable suppliers, you can ensure that your raw materials are delivered on time, in the right quantities, and at the most competitive prices.

Best Practices in Raw Materials Inventory Management

Embrace Automation

Invest in an advanced inventory management system that can automate routine tasks, provide real-time inventory visibility, and facilitate informed decision-making.

Forecast Demand Accurately

Use historical sales data, market trends, and seasonality to predict future demand. This helps to ensure you have the right amount of raw materials on hand at all times.

Establish Strong Relationships with Suppliers

Maintain good relationships with your suppliers. Reliable suppliers can provide better prices, priority service, and valuable industry insights.

Prioritize Quality Control

Ensure that your raw materials meet the necessary quality standards. High-quality raw materials result in high-quality products, leading to customer satisfaction and loyalty.

A Step-by-Step Guide to Calculating Your Raw Materials Inventory Value

Let’s delve into how you can calculate the value of your direct materials inventory effectively :

Understand the Basics

First, it’s important to know that raw materials inventory is typically valued using one of three primary methods: First-In, First-Out (FIFO), Last-In, First-Out (LIFO), or the Average Cost Method. Each has its merits and drawbacks, and the best choice depends on the nature of your raw materials and your business model.

FIFO (First-In, First-Out)

The FIFO method assumes that the first raw materials acquired are the first ones used in production. This approach makes the most sense for perishable goods or materials that may become obsolete quickly.

LIFO (Last-In, First-Out)

The LIFO method assumes that the most recently acquired raw materials are the first ones used. This may be suitable for industries where raw material costs are steadily increasing, as it can help to reduce taxable income.

Average Cost Method

The Average Cost Method calculates a weighted average cost per unit of inventory, based on the cost of goods available for sale and the number of units available for sale. This method smoothes out cost fluctuations and may be easier to apply when inventory items are very similar.

The Calculation Process

Step 1: Identify Your Inventory Valuation Method

Decide on the most suitable inventory valuation method for your business (FIFO, LIFO, or Average Cost). Your choice will significantly impact your calculated inventory value.

Step 2: Determine Your Inventory Counts

Perform a physical count of your direct materials inventory. It’s crucial to have accurate, up-to-date numbers for the next steps.

Step 3: Calculate Your Inventory Value

After determining your inventory counts, you’ll need to apply your chosen valuation method. Let’s illustrate each method with an example:

Let’s assume you have 100 units of Material A. Initially, you bought 50 units for $10 each, and later, you bought 50 units for $15 each.

- FIFO: Under FIFO, you would first deplete the inventory bought for $10/unit. If you’ve used 60 units, your remaining inventory value would be 10 units at $10/unit and 30 units at $15/unit, for a total of $650.

- LIFO: With LIFO, you would first use the inventory bought for $15/unit. If you’ve used 60 units, your remaining inventory value would be 40 units at $10/unit, totaling $400.

- Average Cost: The average cost per unit would be (($10 * 50 units) + ($15 * 50 units)) / 100 units = $12.50/unit. If you’ve used 60 units, your remaining inventory would be 40 units valued at $12.50/unit, totaling $500.

Remember to record all your calculations accurately and update your records regularly to keep your raw materials inventory value current.

Step 4: Regularly Reassess Your Valuation Method

It’s important to regularly reassess whether your chosen valuation method is still the best fit for your business. Market conditions, material costs, and business operations change over time, and so should your valuation method if it’s beneficial.

Demystifying the Raw Materials Inventory Turnover Ratio: A Step-by-Step Guide

Knowing your raw materials inventory turnover ratio is key to understanding the efficiency of your business operations. It provides insights into your inventory management, sales performance, and liquidity. But how do you calculate it? Let’s explore this in detail.

Understanding the Raw Materials Inventory Turnover Ratio

Inventory turnover is a ratio that shows the number of times a business has sold and replaced its inventory during a specific period. For raw materials, it tells you how frequently you’re using up your raw materials in the production process.

A high turnover ratio generally suggests efficient inventory management and strong sales, whereas a low ratio could indicate poor sales, overstocking, or obsolete inventory.

Steps to Calculate Your Raw Materials Inventory Turnover Ratio

Step 1: Determine Your Cost of Goods Sold (COGS)

The first step is to calculate your Cost of Goods Sold (COGS). COGS is the total cost incurred to manufacture goods sold during a specific period. It includes the cost of raw materials and direct labor costs associated with production. This information is typically found in your company’s income statement.

Step 2: Calculate Your Average Raw Materials Inventory

Next, determine your average direct materials inventory for the period you’re analyzing. To do this, add your starting raw materials inventory for the period to your ending direct materials inventory, then divide by two.

Average Raw Materials Inventory = (Starting Inventory + Ending Inventory) / 2

This step smoothes out fluctuations that may occur from seasonal demand or other factors that can distort inventory levels.Step 3: Calculate Your Raw Materials Inventory Turnover Ratio

Finally, divide your COGS by your average direct materials inventory. The result is your raw materials inventory turnover ratio for the specific period.

Raw Materials Inventory Turnover Ratio = COGS / Average Raw Materials Inventory

For instance, if your annual COGS is $500,000 and your average direct materials inventory is $50,000, your raw materials inventory turnover ratio would be 10. This means you’ve turned over your raw materials inventory ten times during the year.

Interpreting Your Raw Materials Inventory Turnover Ratio

Once you’ve calculated your ratio, compare it against industry standards or your past performance to gauge your inventory management efficiency. Remember, a high ratio implies swift inventory movement, reflecting strong sales and effective inventory management. Conversely, a low ratio could signify overstocking or slow sales, warranting a review of your inventory practices.

Final Thoughts

Calculating your direct materials inventory turnover ratio is a powerful tool in your inventory management arsenal. It allows you to understand your operational efficiency better and enables you to make data-driven decisions that could significantly enhance your business performance. Stay on top of this key ratio, and you’re well on your way to a more profitable business operation.

What is Inventory Control?: The Ultimate Guide to Maximizing Efficiency and Profit