Understanding the Cost of Goods Sold (COGS) is crucial to manage your business finances effectively. It plays a pivotal role in evaluating the financial health of a company, impacting the net profit and overall fiscal performance. This article aims to provide a comprehensive guide to Cost of Goods Sold, it’s significance on your income statement, and how it influences your business decisions.

1. Definition of Cost of Goods Sold (COGS)

The Cost of Goods Sold (COGS) refers to the direct costs associated with producing goods or services that a company sells. These costs encompass direct labor, direct materials, and manufacturing overheads, which are vital components in determining the financial health of a company.

2. Importance of COGS

COGS plays a crucial role in determining a business’s profitability. By subtracting Cost of Goods Sold from your sales revenue, you obtain the gross profit, a key performance indicator (KPI) that evaluates your operational efficiency. Additionally, an accurate Cost of Goods Sold calculation is essential for inventory valuation, which in turn influences your balance sheet.

3. Cost of Goods Sold Calculation: A Step-by-Step Process

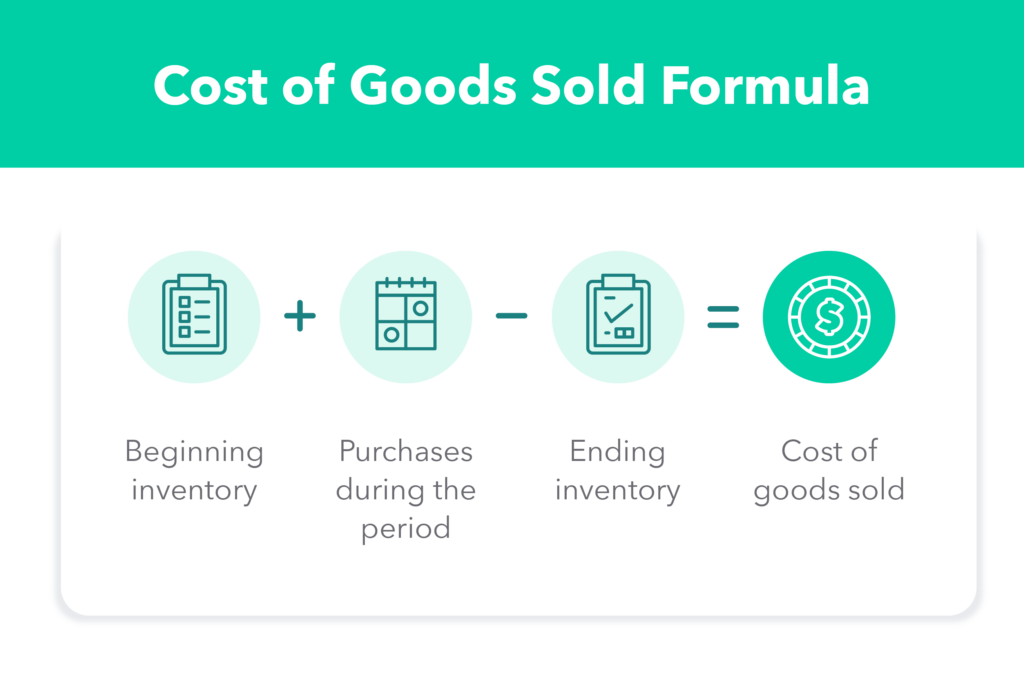

The formula for calculating COGS is as follows:

Let’s break down this formula:

- Beginning Inventory: This represents the cost of the inventory you have at the start of the accounting period.

- Purchases during the Period: This involves all the additional inventory costs incurred during the accounting period.

- Ending Inventory: This is the remaining inventory at the end of the accounting period.

By subtracting the ending inventory from the sum of the beginning inventory and purchases, you derive the COGS.

4. The COGS Formula and Inventory Accounting Methods (continued)

The choice of inventory accounting method can significantly affect the calculation of Cost of Goods Sold. The three most commonly used methods are:

- First-In-First-Out (FIFO): This method assumes that the oldest items in the inventory are sold first. As a result, the ending inventory consists of the most recently acquired or produced items.

- Last-In-First-Out (LIFO): This method assumes that the most recently acquired items are sold first, leaving the oldest items in the ending inventory.

- Weighted Average Cost: This method calculates an average cost per unit of inventory by dividing the total cost of goods available for sale by the total units available for sale.

Each of these methods can result in different COGS and ending inventory values, especially in periods of changing prices.

5. Differences Between Cost of Goods Sold, Operating Expenses, and Other Costs

Cost of Goods Sold should not be confused with operating expenses and other costs. While COGS relates to the direct costs involved in producing a product or service, operating expenses refer to the indirect costs associated with running a business, such as sales and marketing expenses, rent, utilities, and administrative costs.

6. Impact of Cost of Goods Sold on Inventory Management

A deep understanding of COGS can significantly improve your inventory management. It allows you to identify high-cost items in your inventory, enabling more strategic purchasing decisions. Moreover, it aids in the efficient pricing of your products or services, leading to improved profit margins.

7. COGS and Tax Implications

COGS can also affect your tax obligations as it directly impacts your taxable income. A higher Cost of Goods Sold reduces your taxable income, while a lower Cost of Goods Sold increases it. Therefore, accurate COGS calculation is crucial to avoid potential tax-related complications.

8. Best Practices for Reducing Cost of Goods Sold

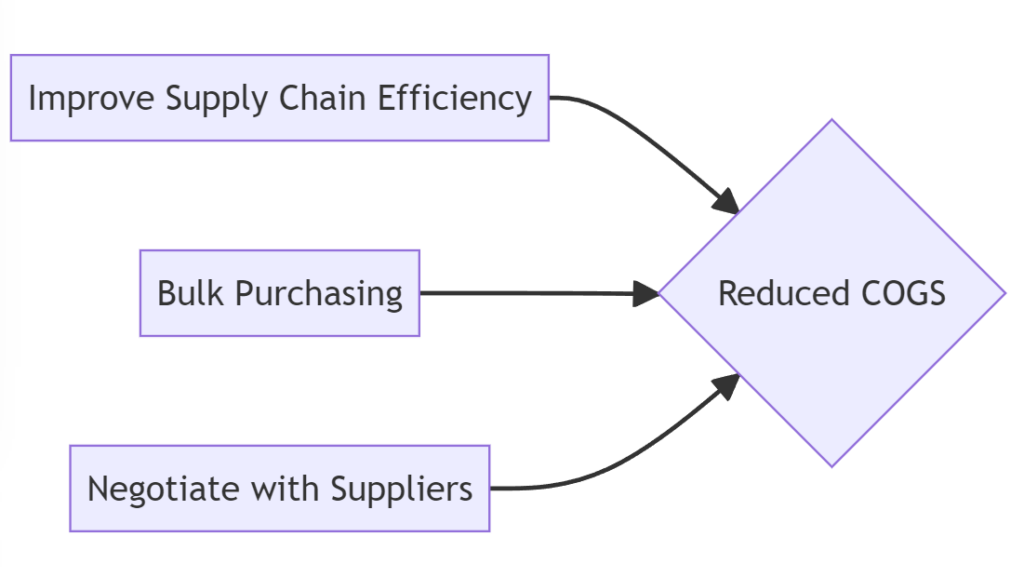

Reducing COGS can enhance your company’s profitability. Here are some strategies:

- Improve Supply Chain Efficiency: Streamlining your supply chain can lead to cost savings in production and delivery.

- Bulk Purchasing: Buying in larger quantities often results in discounts, thus reducing Cost of Goods Sold.

- Negotiate with Suppliers: Regular negotiation with suppliers can help in securing better pricing.

9. Utilizing Technology to Manage Cost of Goods Sold

Modern businesses can benefit from using technology to manage Cost of Goods Sold. Inventory management software can provide real-time insights into inventory levels, assist in forecasting, and help optimize procurement and storage costs.

10. Conclusion

Understanding and efficiently managing the Cost of Goods Sold is crucial to any business’s financial health. It influences profitability, inventory management, pricing strategies, and tax obligations. Therefore, business owners and managers must accurately calculate and strategically reduce COGS to maximize profits and optimize operations.