Inventory holding costs represent a significant aspect of your business operations. Understanding how to effectively manage them can propel your organization to new heights, unlocking profits, enhancing efficiency, and streamlining your supply chain.

What are Inventory Holding Costs?

Inventory holding costs are the expenses associated with storing and maintaining inventory before it’s sold. They include warehousing costs, depreciation, obsolescence, insurance, and more. These costs can eat into your profits if not properly managed.

The Impact of Holding Costs on Your Business

Carrying Costs can have a profound impact on a company’s financial health. High holding costs may cause companies to keep minimal inventory, which could lead to stockouts and lost sales. On the other hand, low holding costs might encourage overstocking, leading to obsolescence and wasted resources.

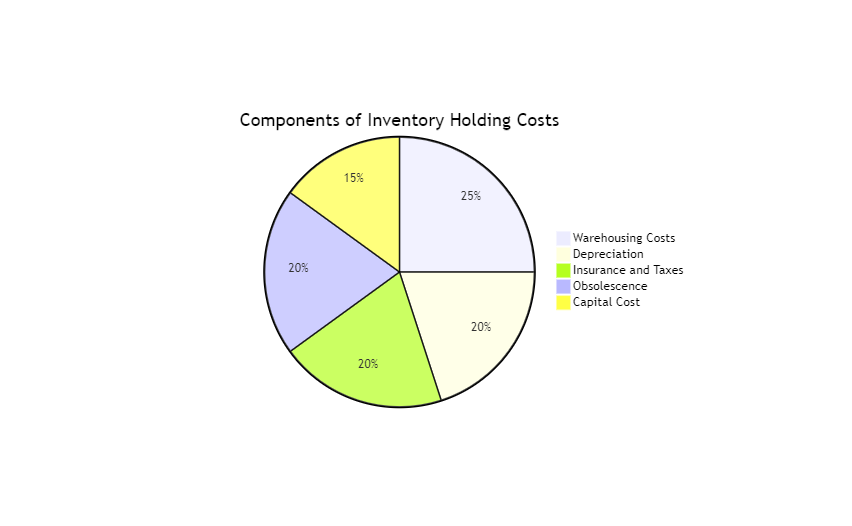

Components of Inventory Holding Costs

There are several elements that make up your inventory holding costs:

- Warehousing Costs: The cost of the space needed to store your inventory.

- Depreciation: The decline in value of goods over time.

- Insurance and Taxes: The costs associated with insuring your inventory and the property taxes on your warehouse.

- Obsolescence: The costs associated with inventory becoming outdated or irrelevant.

- Capital Cost: The opportunity cost of the money tied up in inventory that could have been used elsewhere.

Calculating Inventory Holding Costs

The formula to calculate inventory holding costs is as follows:

Total Inventory Holding Cost = (Average Inventory Value * Holding Cost as a Percentage of Inventory Value) / Number of Periods

Let’s break it down:

- Average Inventory Value: It’s the mean value of your inventory over a specific time period. You can calculate this by adding your starting and ending inventory values for the period and dividing it by two.

- Holding Cost as a Percentage of Inventory Value: This percentage varies from business to business but is typically around 20% to 30%. It represents the proportion of the inventory value that goes towards the holding costs.

- Number of Periods: This is the duration for which you are calculating the holding cost. The period could be annually, quarterly, monthly, or weekly, depending on your business requirements.

By plugging in these values into the formula, you can determine your total inventory holding cost.

Real-Life Example

Let’s put this calculation into perspective with a real-life example:

Assume your business had a starting inventory value of $100,000 and an ending inventory value of $150,000 for the quarter. The holding cost percentage is 25%.

Firstly, calculate the average inventory value:

Average Inventory Value = ($100,000 + $150,000) / 2 = $125,000

Next, plug this value into the formula to get the total inventory holding cost:

Total Inventory Holding Cost = ($125,000 * 25%) / 1 (quarter) = $31,250

So, your inventory holding cost for the quarter is $31,250.

Reducing Inventory Holding Costs

Here are some strategies to reduce your inventory holding costs:

- Streamline your inventory management: Implement an inventory management system to track inventory levels accurately, reducing the chance of stockouts or overstocking.

- Improve forecast accuracy: Use advanced forecasting tools to predict demand accurately, helping you keep optimal inventory levels.

- Leverage just-in-time inventory: Just-in-time (JIT) inventory can minimize carrying costs by reducing the time inventory is held before being sold.

- Review supplier agreements: Renegotiate terms with suppliers to improve delivery times or reduce minimum order quantities.

- Implement cycle counting: Regularly count a subset of inventory to identify and correct discrepancies.

How Much are Holding Costs on Average?

Average holding costs typically account for about 20% to 30% of a company’s total inventory value. This means if your business has an inventory worth $1 million, your average annual holding costs may range from $200,000 to $300,000.

It’s essential to remember that this is a rough estimation and the actual costs can differ based on the following factors:

- Nature of Goods: Perishable goods often have higher holding costs due to the need for specialized storage conditions. Similarly, high-value items may incur higher insurance costs.

- Location: Warehousing costs can vary widely based on the location. Urban areas often have higher real estate costs, which can inflate warehousing expenses.

- Inventory Management Efficiency: The efficiency of your inventory management system can significantly impact carrying costs. Advanced systems can minimize warehousing needs and decrease the likelihood of obsolescence.

- Scale of Operations: Larger operations may benefit from economies of scale, which could reduce per-unit holding costs.

Key Performance Indicators (KPIs) for Inventory Holding Costs

KPIs are metrics that help measure the efficiency and effectiveness of business processes. Here are some critical KPIs for carrying costs:

- Average Inventory Value: The average value of inventory held during a certain period.

- Stock Turnover Ratio: The number of times inventory is sold and replaced in a period.

- Carrying Cost of Inventory: The total cost of storing unsold goods.

- Days of Inventory Outstanding (DIO): The average number of days inventory is held before being sold.

Through careful management and continuous monitoring of these KPIs, businesses can effectively manage their inventory holding costs, ultimately increasing profitability and operational efficiency.

Six Strategies to Slash Your Holding Costs

Keeping a tight rein on holding costs is a common challenge for businesses. High holding costs can eat into your profits and tie up capital that could be better used elsewhere. To help you navigate this complex landscape, here are six effective strategies to trim your holding costs without compromising your operational efficiency.

1. Optimize Inventory Levels

The most direct way to reduce holding costs is by optimizing your inventory levels. Holding excess inventory can lead to higher warehousing costs and increase the risk of obsolescence. Adopt an inventory management system that accurately forecasts demand to help you maintain optimal stock levels. Tools that use historical sales data, seasonality, and market trends can be especially useful.

2. Implement a Just-In-Time (JIT) Approach

The JIT approach involves receiving goods only as they are needed in the production process. This method can significantly cut down on storage costs, reducing the amount of inventory held at any given time. It also lowers the risk of stock becoming obsolete or spoiled. However, it requires precise demand forecasting and reliable suppliers.

3. Improve Warehouse Organization

Efficient use of warehouse space can lead to substantial cost savings. Consider implementing a warehouse management system (WMS) that helps optimize the arrangement of goods. Effective strategies might include grouping items that are often sold together or using vertical space to increase storage capacity.

4. Negotiate with Suppliers

Negotiating better terms with your suppliers can lead to lower holding costs. This could involve securing lower prices for bulk purchases, longer payment terms, or quicker delivery times. Such negotiations can help reduce the amount of inventory you need to hold and the length of time you hold it.

5. Invest in Quality Control

Investing in quality control can help you identify and address issues earlier in the supply chain. This could prevent the need to hold and dispose of defective inventory, thereby reducing holding costs. Quality control measures might include thorough supplier vetting, regular product inspections, and robust return policies.

6. Sell or Donate Excess Inventory

If you have excess inventory that is tying up capital and inflating holding costs, consider selling it at a discount

Conclusion

In the world of inventory management, understanding and controlling inventory holding costs is crucial. It requires a deep comprehension of the components of these costs, the ability to calculate them accurately, and the skill to implement effective management strategies. By carefully monitoring your inventory KPIs, you can make data-driven decisions to reduce costs and optimize your inventory management process.