Inventory management constitutes an indispensable component of any thriving retail operation. Among the various approaches employed in the business realm, the First-In, First-Out (FIFO) method has emerged as a popular strategy. This paper endeavors to provide a comprehensive examination of the FIFO method within the context of inventory management, elucidating its core principles, benefits, and potential drawbacks.

Theoretical Underpinnings of FIFO

The First-In, First-Out method represents a system of inventory management where the oldest inventory items, or those first to be acquired, are sold first. This approach is synonymous with the natural flow of inventory for most businesses, particularly those dealing with perishable goods. FIFO assumes that the earliest purchased or made goods are sold first, with costs recognized in the same sequence.

Mathematical Representation of FIFO

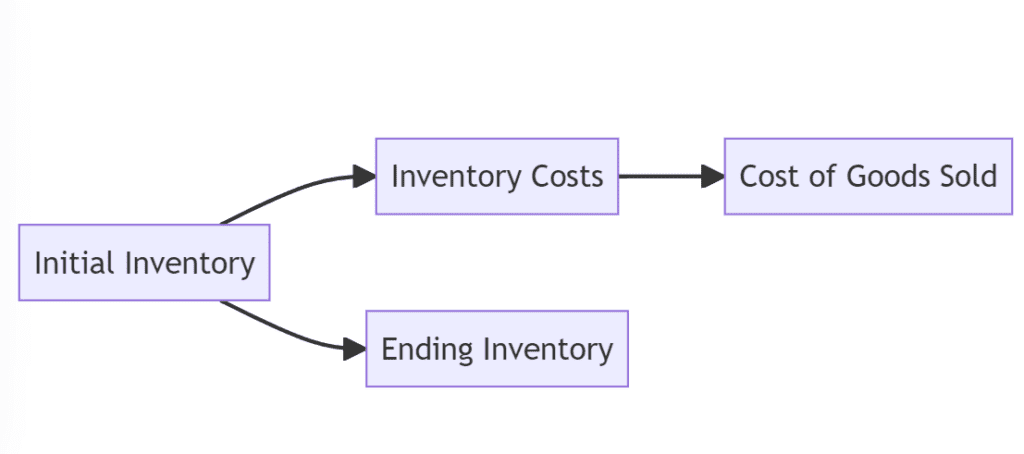

How the FIFO inventory valuation method works

The First-In, First-Out method operates by selling the oldest items in inventory first, which mirrors the natural stock flow for many businesses. The cost of the earliest items is shifted first from “Inventory” to “Cost of Goods Sold (COGS)” on financial statements, influencing gross profit and net income. In inflationary periods, FIFO reports the cost of older, cheaper items first, resulting in lower COGS, higher gross profit, and higher net income. The remaining inventory is valued at the latest, often higher, cost. However, in deflationary times, the First-In, First-Out can lead to a higher COGS and lower gross profit, as more expensive items are considered sold first, with the remaining inventory valued at the recent lower cost. Despite its simplicity and alignment with natural goods flow, the influence of market conditions on FIFO inventory valuation and subsequent financial reporting must be considered.

Examples of calculating inventory using FIFO

Comprehending the First-In, First-Out inventory valuation method becomes clearer with practical examples. Let’s consider a hypothetical retail business that has made the following purchases over a three-month period:

- January: Purchased 100 units at $10 each

- February: Purchased 200 units at $15 each

- March: Purchased 150 units at $20 each

Now, let’s say this business sold 250 units in March. To calculate the Cost of Goods Sold (COGS) and the remaining inventory using the FIFO method, we must first remove the cost of the units sold from the inventory, starting with the oldest stock.

The business first sells all 100 units from January and 150 units from the February purchases, making a total of 250 units sold. This yields the following COGS:

- COGS = (100 units * $10) + (150 units * $15) = $1,000 + $2,250 = $3,250

Next, to calculate the ending inventory, we subtract the COGS from the total cost of inventory:

- The total cost of inventory is calculated as (100 units * $10) + (200 units * $15) + (150 units * $20) = $1,000 + $3,000 + $3,000 = $7,000.

- The ending inventory is therefore $7,000 – $3,250 = $3,750.

Using FIFO, the ending inventory includes the leftover 50 units from February and 150 from March, valued at their more recent costs, thus mirroring current market value.

Through systematic the First-In, First-Out implementation, businesses can effectively manage inventory, enhance financial reporting, and boost profitability.

Advantages and Disadvantages of the First-In, First-Out: A Balanced Evaluation

The FIFO method offers several compelling advantages, yet it is not devoid of potential drawbacks.

Advantages of FIFO

- Natural Flow: FIFO aligns with the natural flow of inventory in many businesses, contributing to its popularity.

- Lower Cost of Goods Sold: During price inflation, FIFO leads to lower COGS, thereby increasing net income.

- Reduced Obsolescence: The First-In, First-Out reduces the likelihood of inventory obsolescence, a significant advantage for businesses dealing with perishable goods.

Disadvantages of FIFO

- Increased Taxes: In inflationary periods, FIFO can lead to higher taxes due to increased net income.

- Distorted Profit Margin: During inflation, FIFO can cause overstatement of profits, thus distorting profit margin.

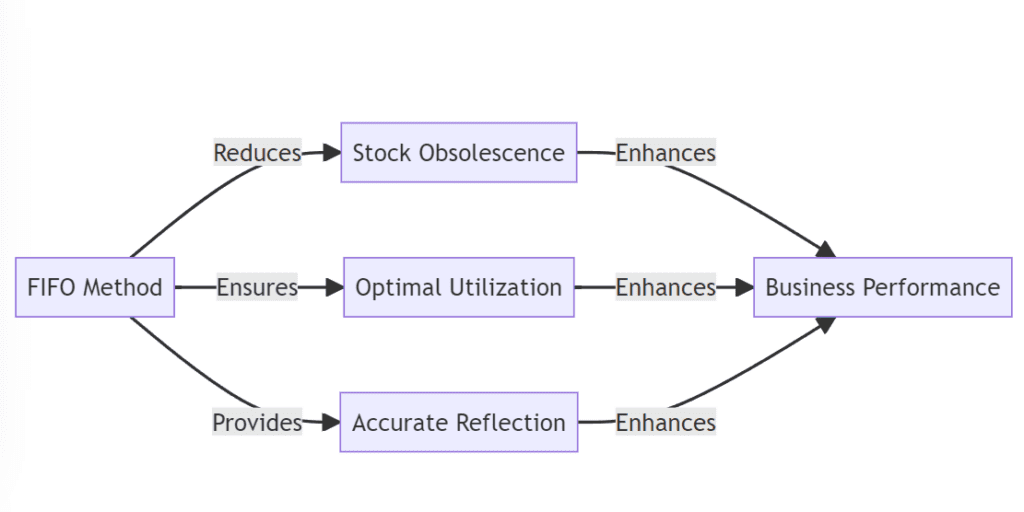

The Practical Implications of the First-In, First-Out

From a practical standpoint, The First-In, First-Out plays an instrumental role in inventory valuation and profitability. FIFO, by promoting the sale of the oldest stock first, reduces obsolescence risks and optimizes inventory use. It further provides an accurate reflection of the inventory’s current market value, thereby enhancing financial reporting.

Conclusion

In conclusion, The First-In, First-Out method is an efficient inventory management technique offering benefits like less obsolescence, improved use, and precise financial reports. Its effects in inflationary times, including higher taxes and skewed profit margins, call for thoughtful analysis. Despite possible drawbacks, the First-In, First-Out method remains widely used, enhancing operational efficiency and promoting business growth.