Determining the right retail inventory valuation method is a crucial decision for businesses, especially in the dynamic world of retail. One method that often proves invaluable in this context is the retail inventory method. However, understanding who should employ this method and why is fundamental to making informed choices in inventory management. In this discussion, we will delve into the factors that determine who should use the method. Shedding light on the businesses and scenarios where it proves most beneficial.

What are the different inventory methods?

There are several inventory valuation methods that businesses can use to determine the value of their inventory. The choice of method can impact a company’s financial statements and tax liability. Here are some of the most common inventory methods:

First-In, First-Out (FIFO)

Under FIFO, it is assumed that the first items purchased are the first items sold. In other words, the cost of the oldest inventory is matched with the revenue from the first items sold. This method is often used when inventory costs are rising because it results in a higher valuation of the remaining inventory.

Last-In, First-Out (LIFO)

LIFO assumes that the most recently purchased items are the first ones sold. It is particularly useful when inventory costs are rising because it results in a lower valuation of the remaining inventory. However, LIFO may not be allowed in some countries for tax or financial reporting purposes.

Weighted Average Cost

The weighted average cost method calculates the average cost of all units in inventory. It is computed by dividing the total cost of goods available for sale by the total number of units available for sale. This method provides a blended cost for all inventory items.

Specific Identification

This method is typically used for high-value or unique items where each individual item is tracked and assigned a specific cost. It is common in industries like jewelry or art, where items have distinct characteristics and values.

Retail Inventory Method

As discussed earlier, It is used by retailers to estimate inventory value based on the cost-to-retail ratio, making it suitable for businesses with large and diverse inventories.

Standard Cost

Some businesses establish standard costs for their inventory items based on historical data or industry benchmarks. These standard costs are used to value the inventory, and any differences between standard and actual costs are recorded as variances.

Lower of Cost or Market (LCM)

The LCM method involves valuing inventory at the lower of its cost or its current market value. This method is used to prevent overstatement of the inventory’s value when market prices decline.

Just-In-Time (JIT)

JIT inventory management aims to minimize inventory levels by ordering and receiving inventory only when needed for production or sale. This method reduces holding costs but requires efficient supply chain management.

The choice of inventory method can have a significant impact on a company’s financial statements, tax liabilities, and profitability. It is essential for businesses to select the method that best aligns with their industry, financial goals, and regulatory requirements.

When should you use retail inventory method

The decision to use the retail inventory method depends on various factors and circumstances within a retail business. Here are some situations when it is appropriate to use the retail inventory method:

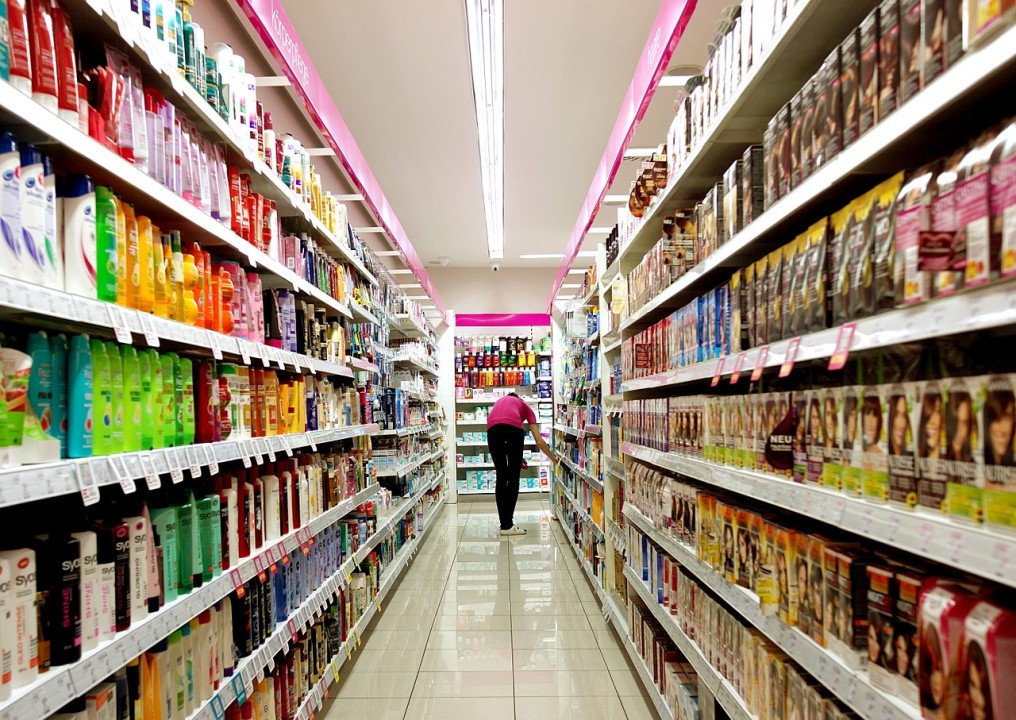

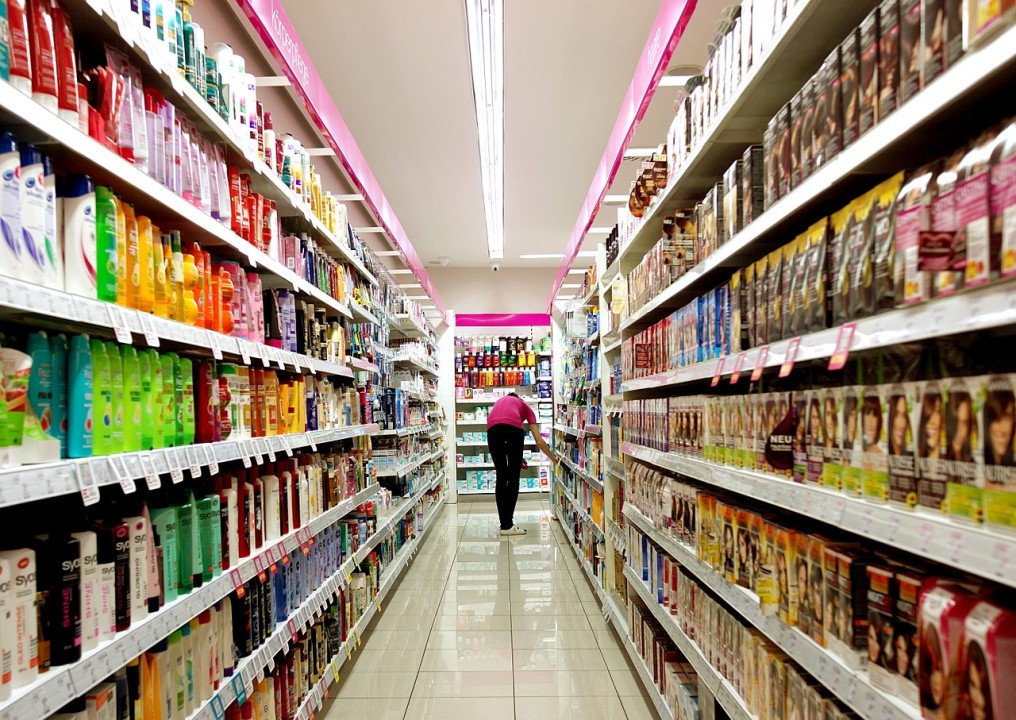

Large and Diverse Inventories

When your business deals with a vast and diverse inventory, such as a department store, supermarket, or clothing retailer, conducting a physical count of every item can be impractical. It provides a practical way to estimate inventory value.

Frequent Price Changes

If your business frequently adjusts prices, offers discounts, or experiences seasonal fluctuations in pricing, the retail inventory method can help you maintain accurate records that reflect these changes. It allows for adjustments to capture price fluctuations effectively.

Efficiency and Cost Savings

When you want to save time and resources associated with physical inventory counts, the retail inventory method offers an efficient alternative. This is especially valuable when you require frequent inventory updates.

Financial Reporting

Businesses often use the retail inventory method for financial reporting purposes. It provides a more accurate representation of inventory value for financial statements, especially when the retail value of the inventory fluctuates significantly.

Compliance with Industry Standards

In certain retail-specific industries, the retail inventory method is considered standard practice. Using this method can align your inventory valuation practices with industry norms and facilitate benchmarking against competitors.

However, it’s important to note that the decision to use the retail inventory method should be made in accordance with accounting principles and regulations applicable to your region or industry. Additionally, maintaining accurate and consistent records is crucial to ensure the reliability of this method for estimating inventory values.

Who uses the retail inventory method?

is primarily used by businesses in the retail industry, particularly those with large and diverse inventories of merchandise. This method is well-suited for retailers who sell a wide range of products, often at varying price points and with frequent price changes. Here are some examples of businesses and sectors that commonly use the retail inventory method:

Department Stores

Large department stores that carry a wide variety of products, including clothing, electronics, home goods, and more, often use the method. These stores may have thousands of individual items in stock, making physical inventory counts impractical.

Supermarkets and Grocery Stores

Grocery retailers with extensive product lines, perishable items, and frequent price changes frequently employ the retail inventory method to manage their inventory efficiently.

Clothing Retailers

Fashion retailers, especially those with seasonal collections and a high volume of products, use the retail inventory method to account for inventory fluctuations due to style changes, discounts, and sales.

Pharmacies

Pharmaceutical retailers with a diverse range of products, including prescription drugs, over-the-counter medications, and health and beauty items, can benefit from this method to track inventory.

Convenience Stores

Small convenience stores that carry a range of products from snacks to household items may use the retail inventory method to streamline inventory management.

It’s important to note that while the retail inventory method is commonly used in the retail sector, its suitability depends on the specific characteristics of the business and its inventory. Retailers must ensure that they adhere to accounting standards and regulations when using this method for inventory valuation, and they should maintain accurate records to support their calculations.