The stock-to-sales ratio is a crucial financial metric that provides valuable insights into a company’s inventory management efficiency. It measures the relationship between a company’s average inventory and its net sales, offering a key indicator of how well a business balances its stock levels with actual consumer demand.

In this discussion, we explore the significance of the stock-to-sales ratio and its implications for businesses.

What is stock-to-sales ratio?

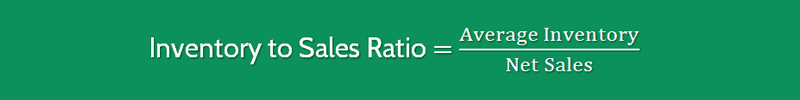

The stock-to-sales ratio is a financial metric that measures the relationship between a company’s inventory (stock) and its sales. It is calculated by dividing the average inventory by the net sales over a specific period.

How to calculate stock-to-sales ratio

To calculate the stock-to-sales ratio, you’ll need two key pieces of information: average inventory and net sales. Here’s the formula and steps to calculate the stock-to-sales ratio:

Stock-to-Sales Ratio=Average Inventory/Net Sales

Follow these steps:

Calculate Average Inventory:

- Add the beginning inventory for the period to the ending inventory and then divide by 2. The formula is: Average Inventory=Beginning Inventory+Ending Inventory

Determine Net Sales:

- Net sales are the total sales minus any returns, allowances, and discounts. The formula for net sales is: Net Sales=Total Sales−Returns−Allowances−Discounts

Plug the Values into the Formula:

- Once you have the average inventory and net sales, use them in the stock-to-sales ratio formula: Stock-to-Sales Ratio=Average InventoryNet Sales

Interpret the Ratio:

- The result of the calculation is the stock-to-sales ratio. Interpretation of the ratio depends on the industry and business model. Generally, a higher ratio may indicate overstocking, while a lower ratio may suggest a potential for stockouts.

Let’s recap with an example:

Suppose a company has a beginning inventory of $50,000, an ending inventory of $70,000, total sales of $500,000, returns of $20,000, allowances of $5,000, and discounts of $10,000.

Average Inventory=$50,000+$70,0002=$60,000

Net Sales=$500,000−$20,000−$5,000−$10,000=$465,000

Stock-to-Sales Ratio=$60,000$465,000≈0.129

In this example, the stock-to-sales ratio is approximately 0.129. Interpretation would depend on industry benchmarks and the company’s specific context.

Why is knowing stock to sales ratio important?

Knowing the stock-to-sales ratio is important for several reasons:

Inventory Management:

- Helps in assessing how efficiently a company is managing its inventory. A high ratio may indicate overstock, tying up capital and space, while a low ratio may suggest potential stockouts.

Working Capital Management:

- Influences the company’s working capital requirements. Efficient inventory management ensures that working capital is used optimally, preventing unnecessary tying up of funds.

Cash Flow Management:

- Affects cash flow, as excess inventory can strain cash resources. Monitoring the stock-to-sales ratio helps in ensuring a healthy balance between inventory levels and cash availability.

Operational Efficiency:

- Reflects the company’s operational efficiency. Maintaining an appropriate stock-to-sales ratio indicates that a business can meet customer demand without unnecessary overstocking or stockouts, contributing to smoother operations.

Avoiding Obsolescence and Discounts:

- Helps in avoiding the risk of inventory obsolescence. Products that remain in stock for an extended period may become outdated, and businesses may need to sell them at a discount or write them off.

In summary, the stock-to-sales ratio provides valuable insights into a company’s operational and financial health. It guides decision-making related to inventory levels, working capital, and overall business efficiency. Businesses with an optimal stock-to-sales ratio are better positioned to adapt to market demands, optimize resource utilization, and maintain healthy financial performance.

What happens if the stock to sales ratio is too high?

If the stock-to-sales ratio is too high, it generally indicates that a company is holding a significant amount of inventory relative to its sales. This situation can have several implications and challenges:

Overstocking:

- A high stock-to-sales ratio suggests that a company may have more inventory on hand than necessary to meet current sales demand. Overstocking ties up capital in goods that are not generating immediate revenue.

Increased Holding Costs:

- Holding excess inventory incurs additional costs, such as storage, insurance, and potential obsolescence. High holding costs can impact overall profitability.

Cash Flow Impact:

- Excessive inventory ties up cash that could be used for other critical aspects of the business. This can strain cash flow and limit the company’s ability to invest in growth opportunities or respond to unforeseen challenges.

Risk of Obsolescence:

- Over time, high inventory levels increase the risk of products becoming obsolete. This can lead to write-offs and discounts to sell outdated stock.

Reduced Flexibility:

- High stock levels can make it challenging for a company to adapt quickly to changes in market demand. It may be difficult to introduce new products or respond promptly to shifts in consumer preferences.

Missed Sales Opportunities:

- Excessively high inventory levels may mean that resources are tied up in products that are not in demand, potentially causing missed sales opportunities for more popular items.

To address a high stock-to-sales ratio, a company may need to implement more effective inventory management strategies, such as optimizing reorder quantities, improving demand forecasting, and identifying slow-moving or obsolete inventory for liquidation. Adjusting procurement practices and streamlining supply chain processes can also help in better aligning inventory levels with actual sales demand.