“Days Sales in Inventory” (DSI) is a critical financial metric that offers insights into how efficiently a company manages its inventory. Understanding DSI is essential for businesses seeking to optimize their inventory turnover and enhance overall operational efficiency. In this exploration, we will delve into the concept of Days Sales in Inventory, unraveling its significance in the realm of financial analysis and supply chain management.

What Is Days Sales In Inventory (DSI)?

Days Sales in Inventory (DSI), also known as Inventory Days or Days Inventory Outstanding (DIO), is a financial metric that measures the average number of days a company takes to sell its entire inventory during a specific period. DSI provides insights into how efficiently a company manages its inventory and the speed at which it can turn its inventory into sales.

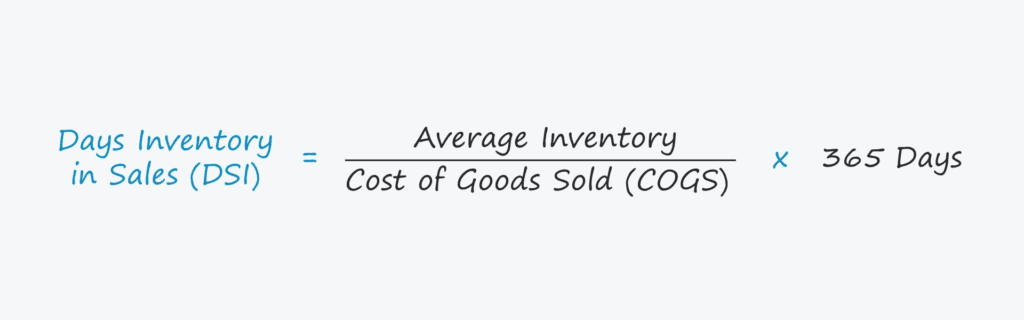

The formula for calculating Days Sales in Inventory is as follows:

Note:

- Average Inventory is the average value of inventory during the specified period.

- COGS represents the total Cost of Goods Sold during the same period.

- Number of Days is the number of days in the period being considered.

A lower DSI indicates that a company is selling its inventory more quickly, which is generally considered favorable. It implies efficient inventory management, reduced holding costs, and a higher likelihood of responding promptly to changes in demand. Conversely, a higher DSI suggests that inventory turnover is slower, potentially leading to higher holding costs, increased risk of obsolescence, and a less responsive supply chain.

DSI is often used in comparison with industry averages or the company’s historical performance to assess its relative efficiency in managing inventory. It is a valuable tool for financial analysts, investors, and managers seeking to evaluate a company’s working capital management and overall operational efficiency.

Why is DSI Important for Your Company?

Days Sales in Inventory (DSI) is a crucial metric for companies as it provides valuable insights into their inventory management efficiency and overall financial health. Here are five reasons why DSI is important for a company:

Optimizing Working Capital:

- DSI helps companies strike a balance between maintaining sufficient inventory levels and preventing excess stock. By minimizing the time it takes to convert inventory into sales, companies can optimize working capital, ensuring that funds are not tied up unnecessarily in inventory.

Reducing Holding Costs:

- Efficient inventory turnover, reflected by a lower DSI, reduces holding costs associated with warehousing, storage, and insurance. Companies can avoid the financial burden of carrying excess inventory for extended periods, leading to improved profitability.

Responsive Supply Chain Management:

- A low DSI indicates a more responsive and agile supply chain. Companies with efficient inventory turnover can adapt quickly to changes in customer demand, market trends, and unforeseen disruptions. This agility is essential for maintaining a competitive edge in dynamic business environments.

Avoiding Obsolescence and Spoilage:

- Rapid inventory turnover, as indicated by a lower DSI, helps companies minimize the risk of products becoming obsolete or reaching the end of their shelf life. This is particularly important in industries with perishable goods or products susceptible to technological advancements.

Enhancing Financial Performance:

- DSI is directly linked to a company’s financial performance. A lower DSI often correlates with higher profitability, improved cash flow, and better return on investment. Investors and stakeholders often scrutinize DSI as part of financial analysis to gauge the efficiency of a company’s operations.

In summary, monitoring Days Sales in Inventory is essential for companies aiming to streamline their operations, improve financial health, and stay competitive in the marketplace. It serves as a key performance indicator, guiding strategic decisions related to inventory management, working capital, and overall supply chain effectiveness.

What is the difference between DSI and DSO?

Days Sales in Inventory (DSI) and Days Sales Outstanding (DSO) are both financial metrics used to assess the efficiency of a company’s operations, but they focus on different aspects of the business. Here’s a breakdown of the key differences between DSI and DSO:

Definition:

- DSI (Days Sales in Inventory): DSI measures how long it takes for a company to sell its entire inventory. It indicates the average number of days it takes for inventory to be sold, highlighting efficiency in inventory management.

- DSO (Days Sales Outstanding): DSO measures the average number of days it takes for a company to collect payment from its customers after a sale. It assesses the efficiency of the company’s credit and collection policies.

Focus:

- DSI: Focuses on inventory management and the speed at which a company can convert its inventory into sales. A lower DSI is generally considered favorable, indicating efficient inventory turnover.

- DSO: Focuses on accounts receivable and the efficiency of the company in collecting payments from customers. A lower DSO is typically considered better, as it suggests quicker cash conversion.

Formula:

- DSI Formula: DSI=(Cost of Goods Sold (COGS)/Number of DaysAverage Inventory)

- DSO Formula:DSO=(Net Sales/Number of DaysAccounts Receivable)

Components:

- DSI: Involves Average Inventory and Cost of Goods Sold (COGS).

- DSO: Involves Accounts Receivable and Net Sales.

Interpretation:

- DSI: A lower DSI indicates efficient inventory turnover, reducing holding costs and the risk of obsolescence. It is associated with a responsive and agile supply chain.

- DSO: A lower DSO suggests quicker cash conversion, improved liquidity, and effective credit and collection policies. It signifies a more efficient accounts receivable process.

Industry Relevance:

- DSI: More relevant for companies with significant inventory, such as retailers and manufacturing businesses.

- DSO: More relevant for businesses that extend credit terms to customers, such as service providers and companies with a B2B (business-to-business) focus.

In summary, DSI and DSO are both valuable metrics for assessing different aspects of a company’s operational efficiency—DSI focusing on inventory management and DSO on accounts receivable and cash conversion.