Introduction

Diving into the world of international commerce, one term often emerges at the forefront – landed cost. As businesses span across borders, understanding the landed cost becomes not just beneficial, but essential. The landed cost is the total cost of a product once it has arrived at a buyer’s doorstep. This includes the initial cost of the product, all transportation fees, customs, duties, and taxes. Let’s explore this crucial concept in detail.

Defining Landed Cost

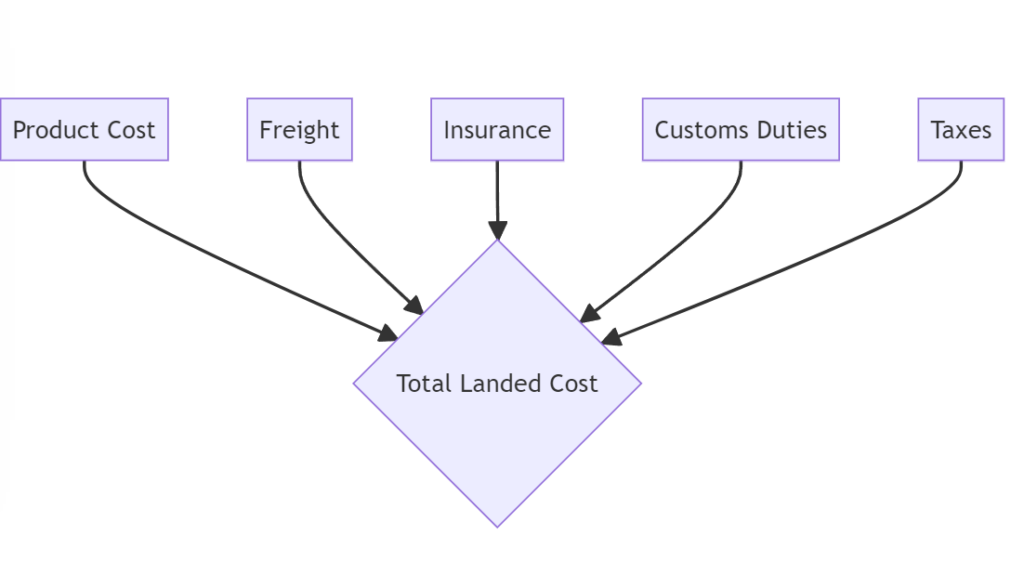

The landed cost is the total price of a product once it has arrived at a buyer’s doorstep. It integrates not only the initial cost of the product but also includes every expense associated with transportation, including freight, insurance, and customs duties.

Unpacking the Components of Landed Cost

Let’s dig deeper into the individual elements that constitute landed cost:

Product Cost

The initial cost of the product sets the groundwork for your landed cost calculation. This amount is what you pay the supplier for the product.

Freight Charges

Freight costs are the charges incurred to move the product from the supplier to the buyer. These can vary widely, depending on the distance, mode of transport, and the weight and volume of the goods.

Insurance

Insurance is a critical, often overlooked component of delivered cost. This fee protects businesses from potential losses or damages during transit.

Customs Duties and Taxes

Customs duties are levies imposed by the importing country’s government. The tax rates typically depend on the type of goods and their declared value.

Why Understanding Landed Cost is Crucial

Knowing the true landed cost of your products is essential for many reasons:

- Profitability analysis: By understanding the full cost of your products, you can accurately calculate your profit margins and make informed pricing decisions.

- Inventory management: Knowing the true cost of goods helps you to value your inventory correctly, essential for effective inventory management and financial reporting.

- Competitive advantage: A comprehensive understanding of delivered cost allows for strategic pricing, thus giving you a competitive edge in the market.

How to Calculate Landed Cost: A Step-by-Step Guide

Calculating delivered cost doesn’t have to be daunting. Here’s a step-by-step guide:

Step 1: Determine the Initial Cost of the Product

This is the amount you pay to purchase the product from the supplier. It forms the base of your landed cost calculation.

Step 2: Add Transportation Fees

This includes the cost of freight or the charge for moving the product from the supplier to your location. Remember, these costs can vary significantly based on several factors, such as distance, mode of transport, and the volume or weight of goods.

Step 3: Account for Customs, Duties, and Taxes

Customs, duties, and taxes can take a significant chunk out of your budget, so they are important to factor in. These costs are levied by the government of the importing country and typically depend on the type of product and its declared value.

Step 4: Include Insurance Costs

Transit insurance protects your business from financial losses in case the goods get damaged or lost in transit. Make sure you factor these costs into your delivered cost calculation.

Step 5: Factor in Additional Costs

Lastly, don’t forget about other costs like currency conversion, crating, handling, and payment fees. These may seem minor but can add up and have a significant impact on your delivered cost.

Once you’ve gathered all this information, the final step is simple – just add up all these costs. The total is your landed cost.

Leveraging Technology to Simplify Landed Cost Calculation

Technology can play a pivotal role in simplifying delivered cost calculation. Software solutions can automate the process, ensuring accuracy and saving time. Additionally, they can offer real-time delivered cost estimates, aiding in strategic decision-making.

Moving Forward with Landed Cost

Mastering ldelivered cost calculation can empower your business to compete effectively in the global marketplace. It will allow you to price your products appropriately, understand your true profit margins, manage your inventory accurately, and comply with financial reporting requirements.

In conclusion

A deep understanding of delivered cost is a potent tool in the arsenal of a globally competitive business. By embracing this concept and leveraging technology to simplify calculations, businesses can make more informed decisions and ultimately, gain a competitive advantage in the global market.