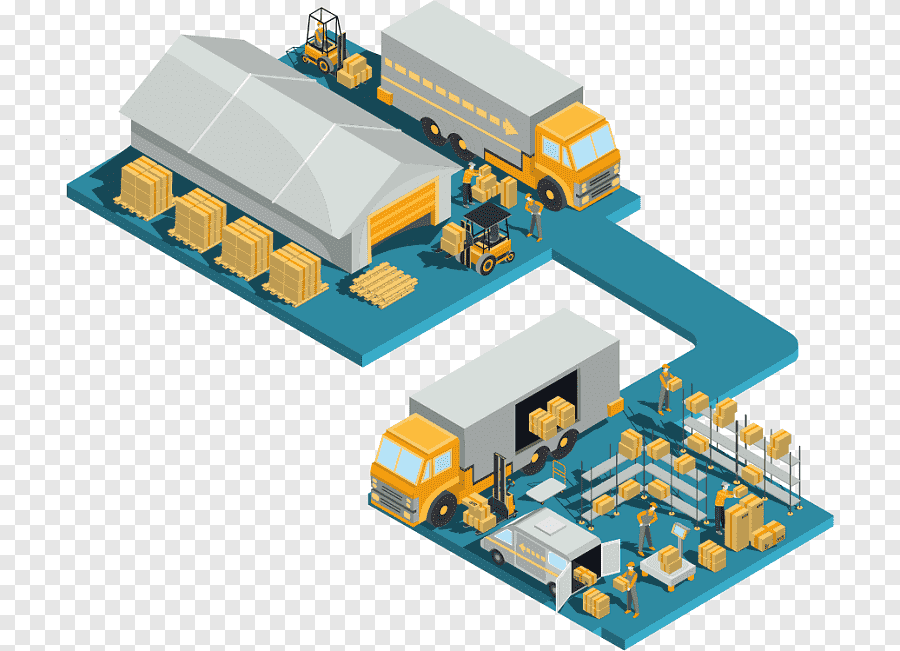

In the intricate landscape of modern international trade and logistics, the concept of a bonded warehouse plays a crucial role that often goes unnoticed by the average consumer. A bonded warehouse is more than just a storage facility; it serves as a strategic hub for businesses engaged in import, export, and distribution.

This article delves into the fundamental question: What is a bonded warehouse? Furthermore, it explores the reasons why companies opt for bonded warehousing as a key component of their supply chain management.

What is customs bonded warehouse?

Customs bonded warehouses, often simply referred to as bonded warehouses, are specialized storage facilities that are authorized by government customs agencies to store imported goods without the payment of customs duties, taxes, or other tariffs until they are either released for domestic consumption or re-exported. These warehouses provide a unique advantage for businesses engaged in international trade by offering a secure and controlled environment for storing goods while deferring the payment of customs duties and taxes until the goods are actually brought into the local market.

What are bonded goods?

Bonded goods, also known as bonded inventory or bonded merchandise, refer to goods that have been stored in a customs bonded warehouse under the supervision and control of customs authorities. These goods are held in these specialized warehouses without the payment of customs duties, taxes, or other import tariffs until certain conditions are met. Bonded goods are subject to specific regulations and processes, and they can serve various purposes for businesses engaged in international trade.

How bonded warehousing works

Bonded warehousing operates within a structured framework established by customs authorities to facilitate international trade while maintaining proper control over imported goods. The process involves storing goods in a customs bonded warehouse under the supervision of customs officials, allowing importers to defer the payment of customs duties and taxes until specific conditions are met. Here’s how bonded warehousing works:

Importation and Entry

When goods arrive in a country, they are first declared to customs authorities. Importers can choose to place the goods in a bonded warehouse instead of immediately paying customs duties and taxes.

Transport to Bonded Warehouse

The goods are then transported to a customs bonded warehouse, which can be either a public warehouse (used by multiple importers) or a private warehouse (owned by a specific company for its own use).

Customs Entry and Supervision

Customs authorities conduct an entry process to document the arrival and storage of the goods in the bonded warehouse. Once inside the bonded warehouse, the goods are placed under customs supervision and control.

Deferred Payment

One of the key benefits of bonded warehousing is that importers can defer the payment of customs duties, taxes, and other import fees until the goods are removed from the bonded warehouse. This provides businesses with a cash flow advantage and allows them to better manage their finances.

Storage and Value-Added Services

While in the bonded warehouse, businesses can engage in various value-added activities such as repackaging, labeling, quality control, and assembly. This customization prepares the goods for local consumption or re-export.

Release for Domestic Consumption

If the importer decides to release the goods for domestic consumption, they must submit the required documentation and pay the relevant customs duties, taxes, and fees. Once these payments are made, the goods can leave the bonded warehouse and enter the local market.

Re-exportation

Alternatively, if the goods are intended for re-exportation to another country, they can be shipped out of the bonded warehouse without incurring local customs duties and taxes.

Record-Keeping and Compliance

Throughout the process, meticulous record-keeping and compliance with customs regulations are essential. Importers must adhere to the rules and guidelines established by customs authorities to maintain the integrity of the bonded goods and the warehouse operations.

Time Limits

There are usually time limits set for how long goods can be stored in a bonded warehouse. If the goods exceed the allowed storage period, the importer may be required to pay customs duties and taxes.

Release and Reporting

When the goods are either released for domestic consumption or re-exported, customs authorities are informed, and the relevant duties and taxes are collected (if applicable).

Bonded warehousing offers businesses a strategic tool for managing their supply chains, optimizing inventory management, and navigating the complexities of international trade regulations. By deferring customs payments and utilizing bonded warehouses, companies can enhance their operational efficiency and better control their financial resources.

Advantages and disadvantages of bonded warehouse

Bonded warehousing offers several advantages and disadvantages that businesses should consider when deciding whether to utilize this storage solution. Here’s a breakdown of the pros and cons:

Advantages of Bonded Warehouse:

- Deferred Customs Duties and Taxes: The most significant advantage is the ability to defer payment of customs duties, taxes, and other import fees until goods are released for domestic consumption or re-export. This provides businesses with improved cash flow and working capital.

- Transshipment and Re-export: Bonded warehousing allows for efficient transshipment and re-exportation of goods without incurring local customs duties. This can streamline international distribution and trade.

- Inventory Management: Companies can store goods in bonded warehouses for extended periods without immediately paying customs fees. This flexibility supports better inventory management and demand forecasting.

- Value-Added Services: Many bonded warehouses offer value-added services such as repackaging, labeling, and quality control. This customization enhances product readiness for different markets.

- Market Testing: Bonded warehousing enables companies to test new markets without committing to full-scale imports. This helps mitigate risks associated with uncertain demand.

- Customs Compliance: Bonded warehouses facilitate compliance with customs regulations and procedures, as goods remain under customs supervision throughout storage.

- Reduced Lead Times: Bonded goods can be quickly released for domestic consumption or re-export, reducing lead times for order fulfillment.

Disadvantages of Bonded Warehouse:

- Storage Costs: While deferring customs duties is advantageous, storage costs in bonded warehouses can accumulate over time, impacting the overall cost-effectiveness.

- Regulatory Complexity: Bonded warehousing involves adherence to strict customs regulations and procedures. Non-compliance can result in penalties or delays.

- Limited Domestic Distribution: Goods stored in bonded warehouses are not readily available for local distribution until customs duties are paid. This may impact timely response to local market demand.

- Storage Time Limits: Many bonded warehouses have storage time limits. If goods exceed these limits, importers may face additional costs or requirements.

- Administrative Burden: Managing the documentation and reporting required for bonded warehousing can be complex and time-consuming.

- Market Volatility: If there are significant changes in customs duties or trade policies, companies utilizing bonded warehousing may need to adjust their strategies accordingly.

- Limited Suitability for Certain Goods: Bonded warehousing is most advantageous for goods with longer storage periods or those earmarked for re-export. Perishable or time-sensitive goods may not benefit as much from this arrangement

Why companies use bonded warehousing

Companies use bonded warehousing for various strategic reasons that contribute to their operational efficiency, cost savings, and competitiveness in the global marketplace. Here are five key reasons why businesses opt for bonded warehousing:

Deferred Customs Payments

Bonded warehousing allows companies to defer the payment of customs duties, taxes, and other import fees until goods are released for domestic consumption or re-export. This deferral improves cash flow and working capital management, enabling businesses to allocate resources more effectively.

Transshipment and Re-export

Bonded warehousing is particularly advantageous for companies engaged in transshipment—importing goods into one country and re-exporting them to another without entering the local market. By avoiding local customs duties, businesses can achieve cost savings and streamline international distribution.

Inventory Management

Bonded warehousing offers flexibility in managing inventory levels. Companies can store goods for extended periods without immediate customs payments, which is especially valuable for seasonal or fluctuating demand. This approach supports efficient inventory management and reduces the risk of stockouts.

Value-Added Services

Many bonded warehouses provide value-added services such as repackaging, labeling, and quality control. This customization allows businesses to tailor products to different markets while the goods are in storage. It enhances market readiness and customer satisfaction.

Risk Mitigation and Security

Storing goods in bonded warehouses provides a secure environment under customs supervision. This reduces the risk of theft, damage, or other hazards associated with less secure storage options. Businesses can rest assured that their goods are protected while awaiting further distribution.

In conclusion, bonded warehousing can offer substantial benefits to businesses engaged in international trade, especially for those involved in transshipment, inventory management, and customized distribution. However, it also comes with potential drawbacks related to costs, regulatory compliance, and suitability for specific goods. Deciding whether to use bonded warehousing requires a careful assessment of a company’s unique trade needs, financial considerations, and long-term strategies.